LATEST NEWS

Read all our latest news articles

How to avoid fees for non-secure payments in three easy steps

First there was the Payment Card Industry Data Security Standard (PCI DSS) and now there is another set of legislation that affects the way merchants collect and store their customers’ personal information...

Secure customer engagement platform

Encoded has announced the availability of its new customer engagement platform that enables contact centres to accept secure customer payments via SMS. An increasingly popular communications channel, using SMS makes it easier for customers to pay bills...

5 Reasons why Cloud is best

Contact centres are often seen as the front line service of a business. They are at the forefront of customer service and therefore the long-term profitability of any organisation. Contact centres need to encompass every aspect of the customer experience...

3 Surprises from latest contact centre report

The UK Contact Centre Decision-Makers’ Guide (DMG) revealed several surprises in terms of PCI compliance and card fraud reduction in its 15th edition. This major report studying the performance, operations, technology and HR...

Scrapping Card Fees

Rob Crutchington, Director at Encoded, discusses the changes for consumers in light of the latest government legislation banning credit and debit card surcharges and who will really benefit as a result. According to the Treasury, in 2010 the total value of surcharges...

GDPR Compliance

With the General Data Protection Regulation (GDPR) coming into force on 25th May 2018, many organisations are starting to consider what it will mean for them. Overriding national data protection laws and including new...

Deferred Debit Cards

Merchants and Payment Services Providers (PSPs) generally deal with three main types of card; Debit Cards, Credit Cards and Charge Cards. The rules and processes surrounding each of these card types has for the most part been clear...

Know more about PCI DSS compliance

We have just published our new booklet “The Truth about PCI DSS compliance in contact centres”, a compilation of blogs discussing many of the issues around this complex subject. Although the Payment Card Industry Data Security Standard (PCI DSS)...

Ditch the CVV

There are a number of myths around the three-digit card verification value (CVV) code found on the back of a MasterCard or Visa card (four-digits on the front if paying by American Express). However, is it time to ditch the code...

Green Star Energy Press Release

Green Star Energy, one of the newest entrants into the UK’s competitive residential energy market, has deployed interactive voice response (IVR) and automated payment technology from Encoded to offer customers a 24-hour meter reading...

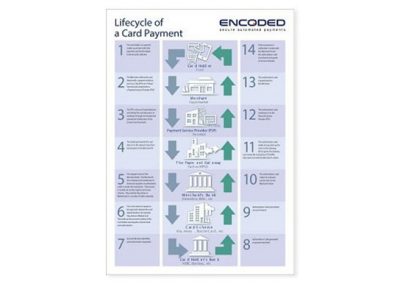

A day in the life of a contact centre card payment

Have you ever thought about what happens once you enter your debit or credit card details into an automated system or read them out to a contact centre agent? The answer isn’t easy but it is more straightforward than many would like you to believe...

Six Design Tips to Improve IVR

Ask people in the street about interactive voice response (IVR) systems and you are likely to get very different viewpoints. Loved by many as a quick way to make a payment, check a balance or top up credit on a mobile ‘phone, many customers...